The Dollar Yen Continues to Rise

The dollar yen pair has been experiencing a prolonged uptrend, and many traders have been capitalizing on this market movement. The Japanese yen is expected to continue weakening over time, especially since the Bank of Japan has shown no signs of adjusting its interest rates. Traders anticipate a breakout above the current zone, with the dollar yen reaching the 145 range. While not catching all the moves, traders have still managed to make some gains.

Gaining a Half a Percent Today

Despite missing out on some of the market movements, traders have still achieved a respectable half a percent gain today. This brings their overall gains to 52.51 percent over the last 12 and a half months. It is important to note that successful trading requires consistent gains over an extended period. Even if some moves are missed, it is still possible to achieve profitable results.

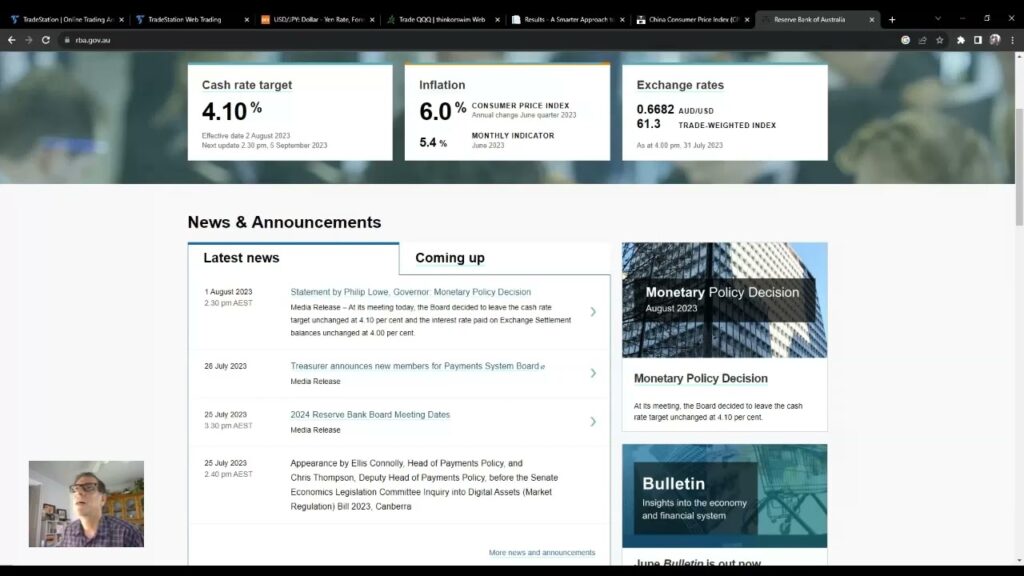

Bank of Australia’s Surprise Decision

In the past 24 hours, the Bank of Australia made an unexpected announcement regarding its interest rates. Contrary to expectations, they decided to keep the rates unchanged at 4.10, despite facing significant inflation. This pause in rate adjustment is intended to allow the markets time to react and the economy to adjust. It is rather intriguing to witness such high inflation without a corresponding increase in interest rates.

Managing Australian Dollar Positions

Traders who had positions in the Australian dollar market were able to benefit from the Bank of Australia’s decision. Anticipating the bank’s choice, some traders exited their positions right before the announcement, avoiding potential losses. While not catching the full extent of the market movement, they still managed to capture a portion of the opportunity. Timing and careful consideration are essential in successful trading.

The Impact of Weakened Chinese and US Manufacturing Data on the Market

Chinese Manufacturing Data Misses Expectations

Recently, China released its manufacturing data, and once again, it failed to meet expectations. The numbers are far from impressive and suggest a worrisome trend. This disappointment has sent signals indicating that the country may be heading towards a recessionary phase. Not only is their Consumer Price Index (CPI) dropping, but their manufacturing data is also equally unattractive.

Disappointing US Manufacturing Data

In addition to China’s underwhelming numbers, the United States has also released its manufacturing data, which is equally concerning. The latest ISM Manufacturing Employment figure stood at 44.4, significantly lower than the expected 48. These figures are alarmingly low and resemble recessionary patterns in the manufacturing sector. There is no doubt that this significant miss will prompt extensive discussions regarding its implications.

Missed Expectations in Manufacturing PMI and Job Openings

Adding to the economic unease, the ISM Manufacturing PMI in the US also fell short of expectations, coming in at 46.4 instead of the anticipated 46.8. Furthermore, the JOLTS job openings data also missed the mark. As a result, it becomes evident that cracks in the narrative of a soft landing in the economy are starting to appear. It is becoming increasingly likely that some form of landing, though uncertain, is imminent.

The Market’s Response

The weakened manufacturing data has not gone unnoticed by the market. Initially, there was a minimal reaction in the NASDAQ, but as time passed, its impact grew more apparent. It is important to consider the long-term bullish chart, which presents an optimistic outlook. However, given the current circumstances, it is highly likely that today will be a down day for the market. It is possible that this could mark the beginning of a downward trend for the NASDAQ, potentially reaching its peak point.

Both China and the United States are facing disappointing manufacturing data, indicating potential econonomic challenges ahead. The missed expectations and significant drops in various indicators cannot be ignored. These developments are likely to have a negative impact on the market, especially in terms of the NASDAQ. As we closely observe these trends, it becomes evident that a soft landing may not be as feasible as previously thought.

Australian Dollar Weakens as Stocks Plummet

As the stock market takes a hit, the Australian dollar is also facing a significant drop in value. Traders are now closely monitoring this currency and its potential impact on the global economy.

An Overview of the Current Situation

The Australian dollar has been weakening consistently in recent times. This steady decline has raised concerns among investors who fear the negative implications it may have on international trade and economic stability.

Despite hopes of a rebound in the near future, the situation remains uncertain and experts are calling for caution.

Possible Dollar Weakening

Many investors are eagerly waiting for signs of dollar weakening that could potentially drive gold prices higher. This anticipation stems from the belief that a weaker dollar typically leads to higher commodity prices, particularly for gold.

However, the market has yet to show clear indications of such a weakening trend. It is essential for traders to closely monitor market conditions and upcoming news to determine the potential impact on gold prices.

Potential Impact on Oil Prices

Another area influenced by the weakening Australian dollar is the oil market. As the currency weakens, oil prices are expected to face downward pressure. This can be attributed to the fact that a weaker Australian dollar makes the cost of importing oil more expensive.

Traders and investors need to exercise caution as they navigate the volatility generated by this currency’s decline.

The Current Financial Landscape

Given the current state of affairs, it is clear that investors and traders are treading carefully. The impact of the Australian dollar’s weakness extends beyond just the currency market; it has wider implications for global economic stability.

While it is difficult to predict the future trajectory of the Australian dollar, it is crucial to stay informed on the latest news and market developments.

The Road Ahead

The coming days will be telling for the Australian dollar and its direction. Traders and investors will be eagerly watching for any signs of recovery or further decline.

In this uncertain landscape, it is important to assess and analyze the potential risks and opportunities that arise from the weakening Australian dollar.

Market participants must remain vigilant, adapting swiftly to changing conditions and making well-informed decisions based on the most up-to-date information.

In the dynamic world of trading, missing out on certain market moves is inevitable. However, with a strategic approach and careful analysis, traders can still achieve substantial gains. The current rise of the dollar yen and the surprising decision of the Bank of Australia have showcased the importance of staying informed and making calculated trading decisions. As traders continue to navigate the ever-changing financial landscape, adaptability and foresight will remain crucial to their success.

The weakening of the Australian dollar and its impact on various sectors of the economy is a cause for concern. Investors and traders must carefully assess market conditions and stay updated with the latest news to make informed decisions.

As the situation unfolds, it is essential to remain cautious and adaptable. The Australian dollar’s uncertain future demands vigilant observation and strategic planning from those who wish to navigate this challenging terrain successfully.